Banks given 3 years to comply with Sh10bn capital threshold

By Alfred Onyango |

The goal is to strengthen the banking sector's resilience and increasebanks' capacity to finance large-scale projects, Treasury Cabinet Secretary Njuguna Ndung'u says.

Banks in Kenya have at least three years to raise their minimum core capital from the current Sh1 billion to Sh10 billion, as recently directed by the Central Bank.

Core capital refers to the minimum capital a bank must have to comply with a country's set regulations.

Keep reading

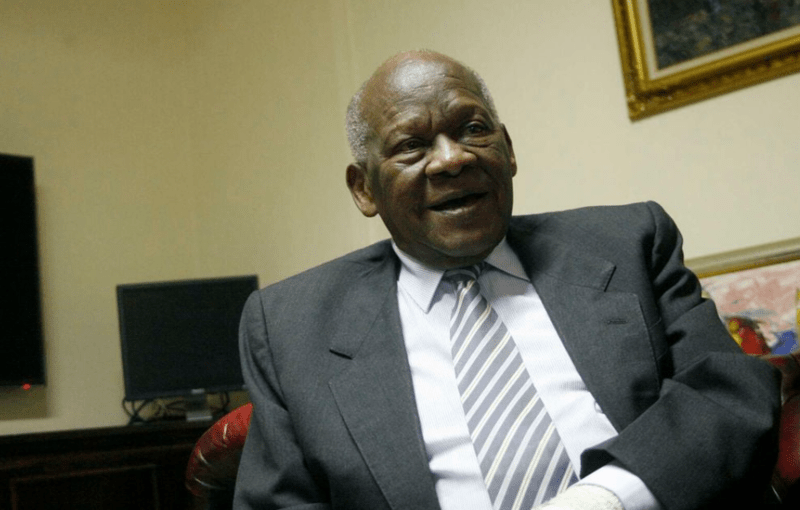

In his budget speech for the financial year 2024–25, Treasury Cabinet Secretary Njuguna Ndung'u said the directive was to strengthen the banking sector's resilience and increase banks' capacity to finance large-scale projects.

"This while creating sufficient capital buffers to absorb and withstand shocks posed by the continuously emerging risks associated with the adoption of technology and innovations as institutions expand," Ndung'u said.

He added that the Kenyan banking sector is exposed to dynamic global, regional, and local developments, a reason that necessitates continuous reforms.

The announcement signified looming consolidations and share offers in the banking sector, especially for small lenders.

Ideally, the directive meant that banks that could not raise their core capital would seek mergers, acquisitions or the closure of their operations.

In 2015, former National Treasury Cabinet Secretary Henry Rotich proposed to increase the minimum capital requirement fivefold to Sh5 billion over three years.

However, the proposal was rejected by the Members of Parliament, who argued it would lead to overconcentration, with the market dominated by a few large banks.

The current requirement was set in 2012 and since 2017, there have been discussions and proposals to increase the minimum core capital to further strengthen the banking sector.